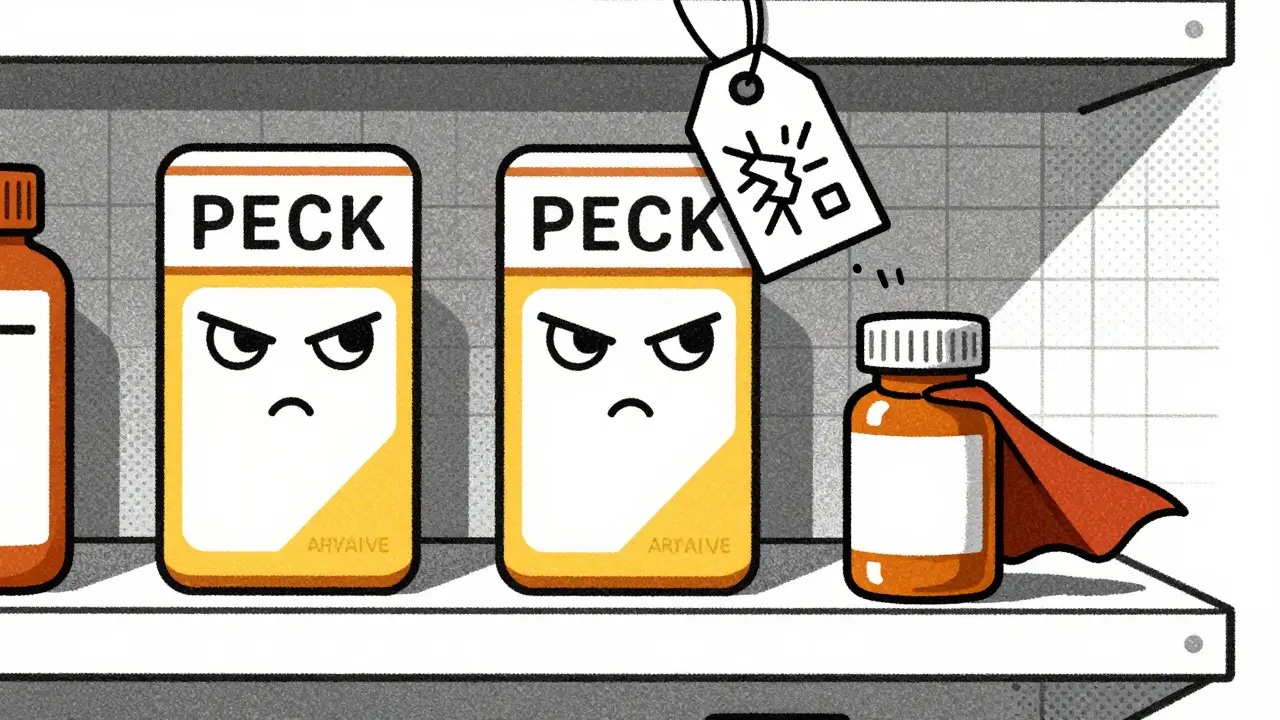

When a brand-name drug loses its patent, the first generic version usually hits the market at about 87% of the original price. That sounds like a big drop-but it’s only the beginning. The real savings come when a second and then a third generic manufacturer enters the race. These aren’t just copycats-they’re price disruptors. And their entry is what turns a modest discount into massive savings for patients, insurers, and taxpayers.

Why the second generic changes everything

The first generic often doesn’t slash prices as much as you’d expect. Why? Because there’s no real competition yet. The first maker has the market to itself, and while they’re cheaper than the brand, they don’t need to go all-in on price cuts. But once a second company gets FDA approval and starts selling the same drug, everything shifts. Suddenly, there are two suppliers fighting for the same business. Pharmacies, wholesalers, and pharmacy benefit managers (PBMs) start playing them off each other. The result? Prices drop to about 58% of the original brand price. That’s a 36% further reduction from the first generic’s price. This isn’t theory-it’s data. The FDA tracked over 2,400 generic drugs approved between 2018 and 2020. In every case, the moment a second manufacturer joined the market, prices plunged. It’s not a coincidence. It’s basic economics: more sellers = lower prices.The third generic hits the accelerator

Now imagine a third company enters. That’s when the price drop becomes dramatic. With three competitors, prices fall to just 42% of the brand’s original cost. That’s more than half off-even after the first generic already cut the price. And it gets even better: in markets with five or more generic makers, prices can fall to 70-80% below the brand’s original price. The numbers don’t lie. The Assistant Secretary for Planning and Evaluation at HHS found that markets with three generic competitors saw an average 20% price drop within three years. But here’s the kicker: markets with just two competitors? Prices barely move. In fact, when competition drops from three to two, prices can spike by 100% to 300%. That’s not a glitch-it’s a pattern. When only two companies control the market, they often act like a duopoly. They avoid price wars. And patients pay the price.What happens when competition fades

It’s not just about getting more companies in-it’s about keeping them there. In nearly half of all generic drug markets, only two manufacturers are active. That’s not competition. That’s a cartel waiting to happen. When a third company exits-because manufacturing is too costly, or because PBMs stop buying from them-prices rise again. The University of Florida found that when a third generic disappears, the remaining two companies often raise prices together. No one’s left to challenge them. This isn’t random. It’s structural. The supply chain is dominated by just three wholesalers-McKesson, AmerisourceBergen, and Cardinal Health-and three PBMs that handle 80% of prescriptions. These giants have enormous leverage. They can choose which generics to buy, and they often favor the cheapest option. That puts pressure on manufacturers to cut costs. Some do it by improving efficiency. Others cut corners-and that’s when shortages start.

Big Pharma’s hidden tactics to block competition

You’d think the system works smoothly once patents expire. But it doesn’t. Brand-name companies have spent decades building walls to keep generics out. One common trick? Pay-for-delay. That’s when the brand pays a generic company to delay its launch. The FDA estimates these deals cost patients $3 billion a year in higher out-of-pocket costs alone. The Blue Cross Blue Shield Association found that banning these deals could save $45 billion over ten years. Another tactic? Patent thickets. One blockbuster drug had 75 patents filed over time, stretching its monopoly from 2016 all the way to 2034. Each patent was a legal roadblock. Generic makers had to fight through courts, delaying entry for years. Even after patents expire, brand companies sometimes refuse to supply samples of their drug to generics-something the 2022 CREATES Act tried to fix. These aren’t edge cases. They’re standard industry practice. And they directly undermine the price-reducing power of second and third generics.Who wins when generics compete?

Patients win. Insurers win. Taxpayers win. Between 2018 and 2020, the entry of new generics saved the U.S. healthcare system $265 billion. That’s not a guess. That’s the FDA’s official estimate. For a common drug like metformin, which now has over 20 generic makers, the price per pill is less than 10 cents. Ten years ago, it was over $1. That’s a 90% drop-all because of competition. PBMs get better deals too. Evernorth Health Services found that when five or more generics are available, they can negotiate discounts of 70% or more. But when only one or two options exist? Those discounts vanish. Hospitals and clinics benefit too. With more suppliers, they can switch providers if one runs out of stock. That’s not possible in a duopoly.

Martin Viau

Let’s be real-this whole generic drug thing is just capitalism doing its job. First guy comes in, charges 87%? Lazy. Second guy? 58%? Now we’re talking. Third guy? 42%? That’s when the system actually works. No one’s ‘helping’ anyone-they’re just fighting for market share. And guess what? Patients win. Stop pretending this is altruism. It’s greed with better PR.