When a brand-name drug loses its patent, the race to sell the first generic version begins. But here’s the twist: the company that made the original drug can also launch its own generic version - and it often does, right when the first generic hits the market. This isn’t a coincidence. It’s a strategy. And it changes everything about how much you pay for medicine.

What’s the difference between a first generic and an authorized generic?

A first generic is made by a separate company that spent years challenging the brand’s patent, doing the science to prove it works the same way, and waiting for FDA approval. These companies invest millions and take big risks. If they win, they get 180 days of exclusive rights to sell the generic version. During that time, they usually have 80% of the market. That’s how they make back their investment - and then some.

An authorized generic is different. It’s made by the same company that produced the brand-name drug, or by a partner they’ve licensed it to. It’s the exact same pill, in the same factory, with the same ingredients. The only difference? It’s sold under a generic label and at a lower price. No new FDA review. No patent lawsuit. No 180-day wait. The brand company can launch it whenever they want - even on the same day the first generic hits shelves.

Think of it like this: you’re the first person to open a coffee shop in a new neighborhood. You’ve got the place ready, the signs up, and you’re the only one selling for six months. Then, Starbucks opens right next door - same coffee, same beans, same baristas - but they call it "Premium Brew" and price it 20% lower. That’s what an authorized generic does.

Why timing matters more than you think

The 180-day exclusivity period was meant to reward the first generic company for taking on the legal and financial risk of challenging a patent. But brand companies learned how to turn that reward into a trap.

Research from Health Affairs shows that in 73% of cases between 2010 and 2019, brand companies launched their authorized generic within 90 days of the first generic’s approval. In 41% of cases, they launched on the exact same day.

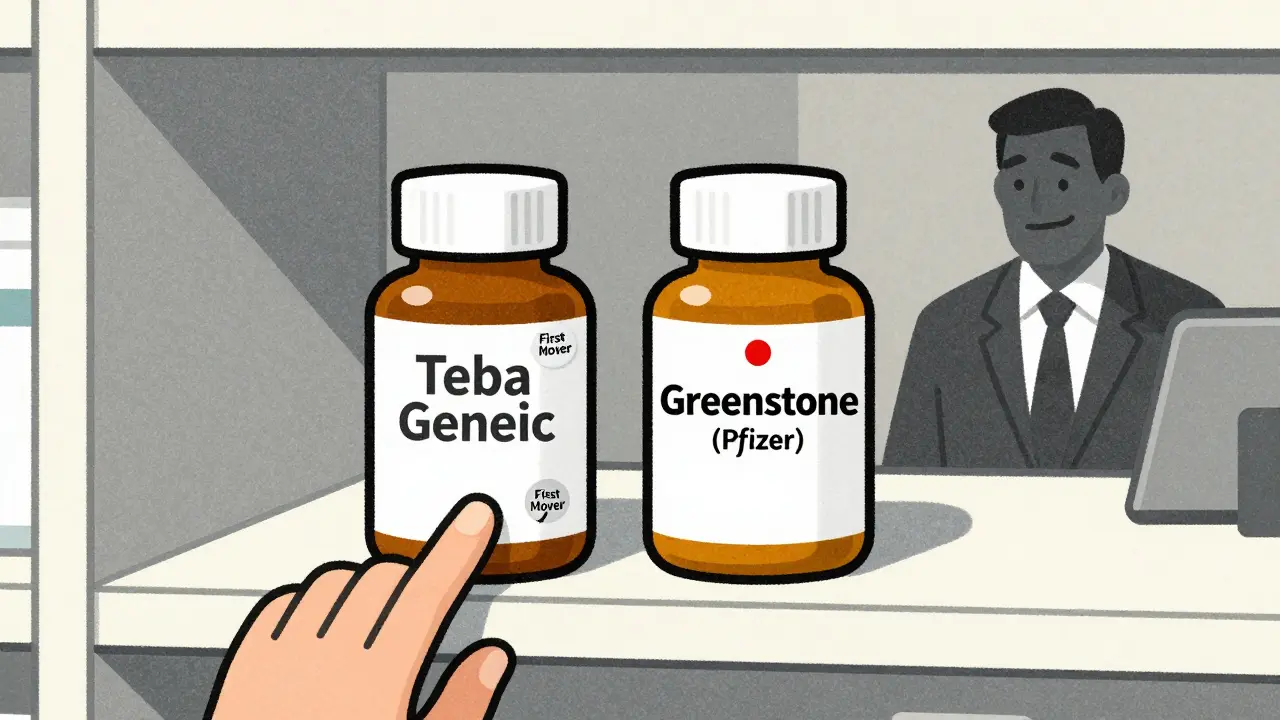

Take Lyrica (pregabalin). When Teva launched its first generic in July 2019, Pfizer - the original maker - immediately rolled out its own authorized generic through Greenstone LLC. Within weeks, Pfizer’s version captured 30% of the market. Teva’s expected $300 million in revenue during its exclusivity window dropped by nearly half. That’s not just bad luck. That’s a calculated move.

It’s not just Lyrica. Similar plays happened with drugs like Eliquis (apixaban), Jardiance (empagliflozin), and even Lipitor (atorvastatin). The brand company doesn’t wait for the first generic to build momentum. They strike before the customer even has a chance to switch.

How this affects your wallet

When a brand drug goes generic, prices usually drop 80-90%. That’s the promise of competition. But when an authorized generic enters at the same time, the drop shrinks to 65-75%.

Why? Because now you have two versions of the same drug competing. The first generic drops its price to stay competitive. The authorized generic drops even lower - sometimes below cost - to grab shelf space. The brand company doesn’t need to make a profit on the authorized version. They’re just trying to keep the first generic from dominating the market.

The result? You pay more than you should. The healthcare system loses billions in savings. And the first generic company - the one that did all the hard work - gets crushed.

According to RAND Corporation, this tactic cost the U.S. healthcare system an estimated $1.2 billion in avoided savings between 2010 and 2019. That’s money that could’ve gone to insulin, cancer drugs, or mental health care.

Who wins? Who loses?

It’s not a simple story of good vs. bad.

The brand companies win. They keep control of the market. They protect their profits. They turn a regulatory loophole into a weapon.

The authorized generic looks like a win for consumers - lower price, same drug. But it’s a shallow win. It doesn’t create real competition. It just replaces one monopoly with a duopoly.

The first generic company loses. They spent years and millions. They won the legal battle. And then the brand company hit them with a surprise attack.

The patients and insurers lose too. Prices don’t fall as far. Savings are delayed. And the incentive to challenge patents - the whole point of the Hatch-Waxman Act - gets weaker.

Some argue that authorized generics increase access. And yes, they do get more people on generics faster. But that’s not the same as healthy competition. It’s more like a trapdoor disguised as a shortcut.

The rules are changing - slowly

Regulators are starting to notice. The Inflation Reduction Act of 2022 made it clear: authorized generics don’t count as "generic competitors" when the government negotiates Medicare drug prices. That’s a big deal. It means brand companies can’t use their authorized generics to dodge price controls.

The FTC has also taken a harder line. The 2013 Supreme Court case FTC v. Actavis ruled that "pay-for-delay" deals - where brand companies pay generics to stay off the market - are illegal. While authorized generics aren’t direct payments, they’re now seen as part of the same playbook.

But enforcement is still patchy. And the FDA’s approval process remains slow. While the agency approved 80 first generics in 2017, most applications still take over a year to review. Meanwhile, authorized generics can be launched in days.

What’s next for generic drug makers?

Generic companies aren’t sitting still. The smart ones are changing their strategy.

- Some are building multiple ANDAs for the same drug - so if one gets blocked, another can jump in.

- Others are partnering with brand companies to co-launch authorized generics, sharing the profits instead of fighting them.

- A few are moving into complex generics - injectables, inhalers, patches - where the barriers to entry are higher and authorized generics are harder to pull off.

But the bottom line hasn’t changed: the window for profitable first-generic entry has shrunk to 45-60 days in many categories. That’s not enough time to build a sustainable business.

By 2027, experts predict authorized generics will make up 25-30% of all generic prescriptions - up from 18% in 2022. That means more drugs will have two versions on the shelf from day one. And fewer will have a true, unchallenged first-mover advantage.

What you should know as a patient

You don’t need to understand patent law to save money. But you do need to know this: not all generics are created equal.

- If your pharmacy gives you a generic, ask: "Is this the first generic?" or "Is this made by the brand company?"

- Price isn’t always the best indicator. Sometimes the authorized generic is cheaper - but only because the brand company is trying to squeeze out the real competitor.

- Ask your pharmacist to check if there’s a true first generic available. It might be slightly more expensive, but it helps keep competition alive.

Every time you choose a generic, you’re voting with your wallet. If you always pick the cheapest, you’re helping the brand company win. If you’re willing to pay a little more for a true first generic - especially when it’s the only one on the market - you’re helping the system work the way it was meant to.

The system was designed to reward risk. Right now, it’s rewarding manipulation. And that’s not just bad for generics. It’s bad for all of us who need affordable medicine.

What’s the difference between a first generic and an authorized generic?

A first generic is made by a company that challenged the brand’s patent and got FDA approval through the ANDA process. An authorized generic is made by the brand company itself (or a partner) and sold under a generic label without needing a separate FDA approval. They’re identical in formula, but the authorized generic can launch anytime - even on the same day as the first generic.

Why do brand companies launch authorized generics at the same time as first generics?

To undermine the 180-day exclusivity period that rewards the first generic company. By launching their own version immediately, they split the market, lower the first generic’s profits, and prevent prices from dropping as far as they should. It’s a legal but controversial tactic to protect long-term profits.

Do authorized generics lower drug prices?

They do lower prices - but not as much as true competition. When only a first generic enters, prices drop 80-90%. When an authorized generic joins on day one, the drop is only 65-75%. The brand company uses the authorized generic to cap the price reduction, keeping more revenue for themselves.

Is it better to choose an authorized generic or a first generic?

If you only care about the lowest price today, the authorized generic might win. But if you want to support real competition and help keep drug prices low long-term, choosing the first generic - even if it’s slightly more expensive - helps the system work as intended. Your choice affects whether future generics can enter the market.

How long does it take for a first generic to get approved?

The FDA’s average review time for a first generic is about 10 months under current rules, but it can take over three years during backlogs. In contrast, authorized generics can launch within days because they use the brand’s existing approval. This timing gap is why brand companies can respond so quickly.

Are authorized generics regulated the same way as other generics?

No. Authorized generics don’t need to submit an ANDA or prove bioequivalence because they’re made under the brand’s original NDA. They’re treated as a brand product sold under a different label. This gives them a regulatory shortcut that first generics don’t have.

TooAfraid ToSay

Wait so you're telling me the system isn't broken? That this is just how capitalism works? I'm shocked. Truly. Next you'll say billionaires don't pay taxes and dogs don't poop in the yard.